# Understanding GST and TDS in India’s Online Gaming Rules: How to Stay Compliant and Save Money

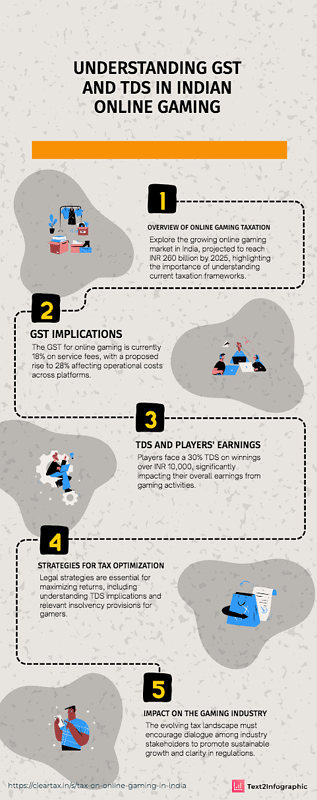

India’s online gaming industry is booming, but with great opportunities come great responsibilities—especially when it comes to taxes. For online gaming enthusiasts and platforms alike, understanding GST and TDS obligations is crucial. Here’s everything you need to know about these taxes and how to legally minimize your liabilities while staying compliant.

## What is GST in Online Gaming?

Goods and Services Tax (GST) applies to online gaming activities, and the rules have recently undergone significant changes.

### Current GST Rates for Online Gaming

As of **October 1, 2023**, all online gaming activities, including skill-based games, are taxed at **28% on the full value of bets, stakes, or entry fees**. This rate applies uniformly to both games of skill and games of chance.

### Impact on Players and Platforms

1. **For Players**: The 28% GST adds to the cost of participation, impacting the net prize pool.

2. **For Platforms**: Platforms must remit GST based on the total stakes they receive, which may affect how prizes and services are structured.

### Tips to Minimize GST Impact

– **Opt for Free-Entry Competitions**: Look for platforms like **Digital Loto**, which regularly offer free or low-cost entry opportunities.

– **Participate in Promotions**: Special promotional events often reduce the effective cost of entry.

—

## What is TDS in Online Gaming?

TDS, or Tax Deducted at Source, is another important tax applicable to online gaming.

### Current TDS Rules

Under Section 194B of the Income Tax Act, **30% TDS** is deducted on winnings exceeding ₹10,000 from a single game or competition. This deduction is made before the prize is disbursed to winners.

### Player Responsibilities

1. Include gaming income in your annual tax return.

2. Use your PAN to ensure accurate TDS reporting.

### Tips to Minimize TDS Impact

– Opt for platforms like **Digital Loto** that offer multiple small prize opportunities to keep winnings below the ₹10,000 threshold.

– Consult a tax advisor to explore permissible deductions that can offset your total tax liability.

—

## Key Differences Between GST and TDS

| **Aspect** | **GST** | **TDS** |

|————————|———————————————-|——————————————|

| **Applicability** | On total stakes or entry fees | On winnings above ₹10,000 |

| **Rate** | 28% | 30% |

| **Who Pays?** | Players (indirectly) | Winners (direct deduction) |

—

## How Digital Loto Simplifies Compliance

At **Digital Loto**, we understand the complexities of GST and TDS. That’s why we:\n\n- Provide transparent breakdowns of all taxes applied.\n- Offer free-entry competitions and small-win opportunities.\n- Ensure compliance with all legal regulations so you can focus on playing and winning.

—

## FAQs

### 1. Why is GST applied to online gaming?

GST ensures uniform taxation across all services, including online gaming, and helps regulate the growing industry.

### 2. Are free-entry competitions subject to GST?

No, free-entry competitions are exempt from GST since they involve no monetary stakes.

### 3. What should I do if TDS is deducted from my winnings?

Request a TDS certificate from the platform and include the amount in your income tax return to claim any eligible refunds.

### 4. Can I offset GST paid on entry fees?

No, players cannot claim input tax credit on GST paid for entry fees.

### 5. How does Digital Loto minimize tax burdens for players?

Digital Loto offers transparent tax disclosures, free-entry events, and multiple smaller prize opportunities to reduce the tax burden on participants.

—

## Disclaimer

The information in this article is for general knowledge only and does not constitute legal or financial advice. Tax rules are subject to change, and individual circumstances vary. Always consult a qualified tax professional for personalized advice.

—

By staying informed and choosing platforms like **Digital Loto**, you can enjoy online gaming while minimizing your tax liabilities. Visit [Digital Loto](https://digitalloto.com) to explore exciting competitions and start winning today!

—